"For Sweden" (rallybeetle)

"For Sweden" (rallybeetle)

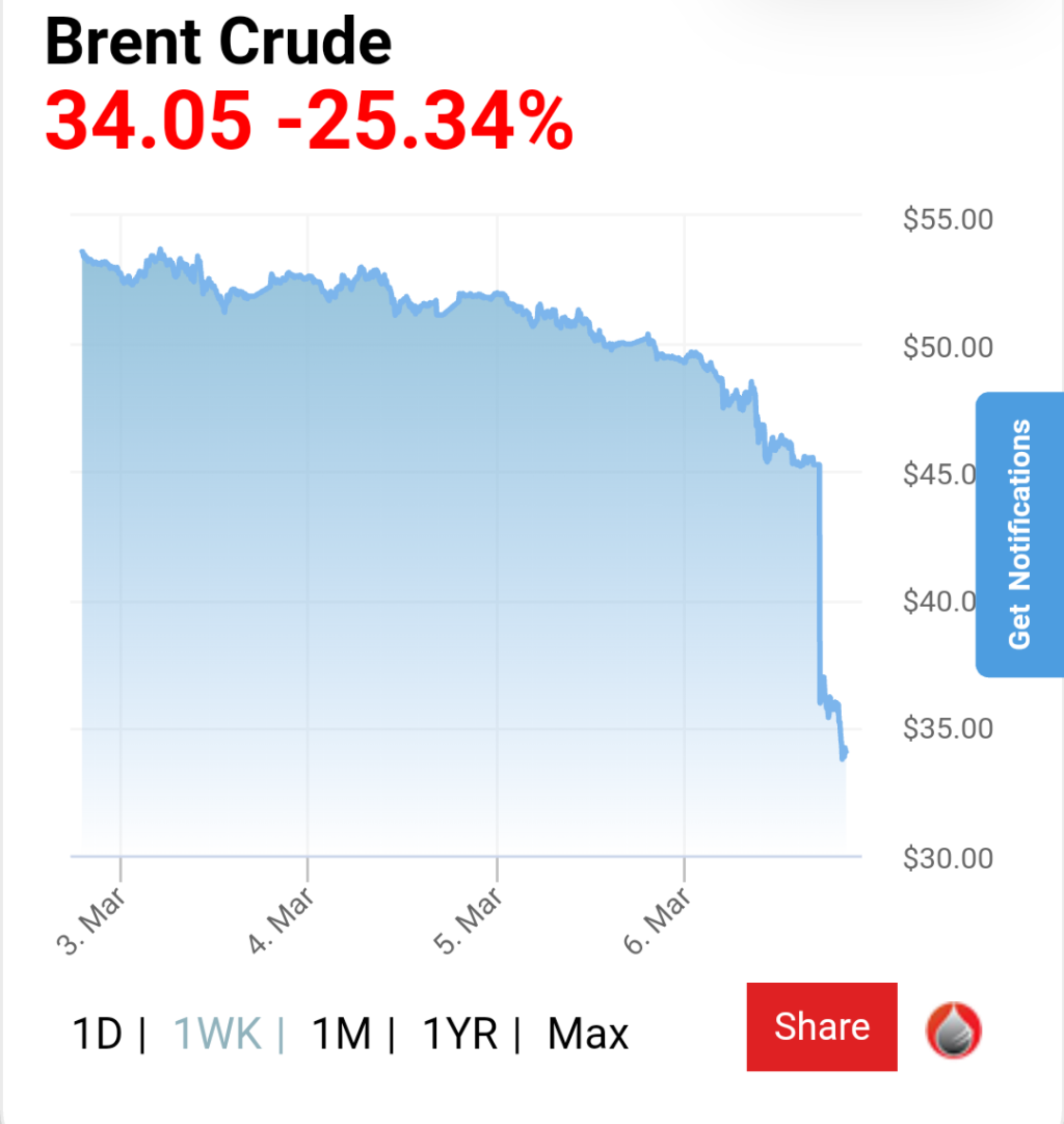

03/08/2020 at 23:08 ē Filed to: oil

2

2

55

55

"For Sweden" (rallybeetle)

"For Sweden" (rallybeetle)

03/08/2020 at 23:08 ē Filed to: oil |  2 2

|  55 55 |

Unless you invest in oil; then RIP.

AestheticsInMotion

> For Sweden

AestheticsInMotion

> For Sweden

03/08/2020 at 23:13 |

|

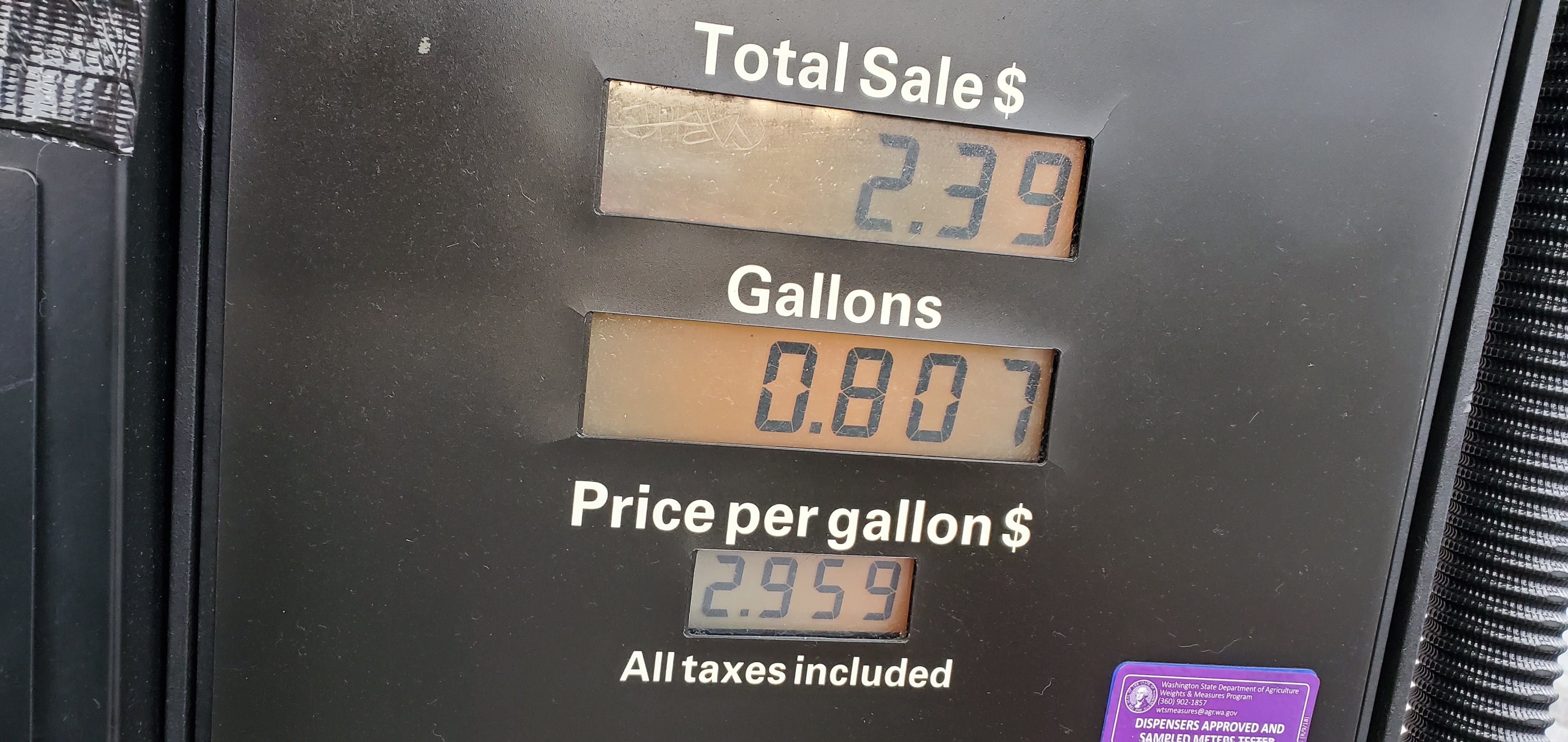

My weekly fillup did seem cheaper than usual

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

03/08/2020 at 23:16 |

|

Awww yeah thatís the stuff

AestheticsInMotion

> Dr. Zoidberg - RIP Oppo

AestheticsInMotion

> Dr. Zoidberg - RIP Oppo

03/08/2020 at 23:18 |

|

I finally get something fuel efficient and oil prices tank. Just my luck :(

interstate366, now In The Industry

> For Sweden

interstate366, now In The Industry

> For Sweden

03/08/2020 at 23:19 |

|

Theyíre bad stocks Brent

For Sweden

> interstate366, now In The Industry

For Sweden

> interstate366, now In The Industry

03/08/2020 at 23:20 |

|

omg

MrDakka

> For Sweden

MrDakka

> For Sweden

03/08/2020 at 23:20 |

|

Just invest in $OIL puts. 4/17 $25p. He ll just buy puts on everything. $SPY puts are †the only things keeping my overall portfolio green

Goggles Pizzano

> For Sweden

Goggles Pizzano

> For Sweden

03/08/2020 at 23:21 |

|

ttyymmnn

> AestheticsInMotion

ttyymmnn

> AestheticsInMotion

03/08/2020 at 23:23 |

|

I saw $1.81 for regular today in Austin. Time for a road trip.†

For Sweden

> ttyymmnn

For Sweden

> ttyymmnn

03/08/2020 at 23:26 |

|

Road trip to a track day

someassemblyrequired

> For Sweden

someassemblyrequired

> For Sweden

03/08/2020 at 23:27 |

|

Imma gonna recoup my oil losses at the pump. $1 gas baby, letís party like itís 1979.

AestheticsInMotion

> ttyymmnn

AestheticsInMotion

> ttyymmnn

03/08/2020 at 23:28 |

|

Wow.†

I have vauge memories of *maybe* seeing $1.99 as a young child. Maybe. Totally possible it was actually $2.99.

WilliamsSW

> For Sweden

WilliamsSW

> For Sweden

03/08/2020 at 23:29 |

|

Crap does this mean the price of hemi Mopars will go up?

facw

> For Sweden

facw

> For Sweden

03/08/2020 at 23:29 |

|

Nothing like the Saudis deciding to cut prices and up production while the demand is decreasing due to COVID-19...

Russia wouldnít play along with cutting production, and so now it seems like the Saudis are just going to try to crush the Russian economy by making Russian oil economically unviable .

For Sweden

> facw

For Sweden

> facw

03/08/2020 at 23:33 |

|

Russiaís going try to †hack the next Saudi election

atfsgeoff

> For Sweden

atfsgeoff

> For Sweden

03/08/2020 at 23:35 |

|

lotsa big companies are keeping as many employees home as possible due to coronavirus. Itís been tanking the demand for oil.

LastFirstMI is my name

> For Sweden

LastFirstMI is my name

> For Sweden

03/08/2020 at 23:37 |

|

Saudi election.... thatís hilarious. Have a star.

For Sweden

> LastFirstMI is my name

For Sweden

> LastFirstMI is my name

03/08/2020 at 23:39 |

|

Mere technicalities cannot stop the Russians

ttyymmnn

> AestheticsInMotion

ttyymmnn

> AestheticsInMotion

03/08/2020 at 23:42 |

|

Iím old enough to remember sub $1 gas in the 80s. But this is nuts.†

JawzX2, Boost Addict. 1.6t, 2.7tt, 4.2t

> AestheticsInMotion

JawzX2, Boost Addict. 1.6t, 2.7tt, 4.2t

> AestheticsInMotion

03/08/2020 at 23:47 |

|

I remember a tim e when regular was $.99 and plus was $1 .0 9/gallon and my Mazda Protege had a 9 gallon tank. I could fill it (with plus, if the light wasn't †on yet!), buy a coke and get change back from a $10. I made $7.25/hour and felt fine about it.†

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

Dr. Zoidberg - RIP Oppo

> AestheticsInMotion

03/08/2020 at 23:47 |

|

On the week before 9-11, I remember gas being 1.19 a gallon.

WilliamsSW

> Goggles Pizzano

WilliamsSW

> Goggles Pizzano

03/08/2020 at 23:48 |

|

Me: boy Iím glad I donít own any oil stoc...

Shit.

LastFirstMI is my name

> For Sweden

LastFirstMI is my name

> For Sweden

03/08/2020 at 23:50 |

|

Maybe the two high ranking royal family members recently arrested for ďtreasonĒ were just liking the wrong comments on Facebook. Or refusing to wear ďMake Arabia Great AgainĒ hats

AestheticsInMotion

> Dr. Zoidberg - RIP Oppo

AestheticsInMotion

> Dr. Zoidberg - RIP Oppo

03/08/2020 at 23:51 |

|

That makes me feel both very young, and very old at the same time.†

AestheticsInMotion

> JawzX2, Boost Addict. 1.6t, 2.7tt, 4.2t

AestheticsInMotion

> JawzX2, Boost Addict. 1.6t, 2.7tt, 4.2t

03/08/2020 at 23:52 |

|

... I remember when I could buy a gallon of chocolate milk for $1.

smobgirl

> AestheticsInMotion

smobgirl

> AestheticsInMotion

03/08/2020 at 23:56 |

|

You must be young!

I remember even in college (ca. 2001) paying $1.25 for premium for my Datsun and being mad that it was 25 cents more than everyone else in my family had to pay.

dtg11 - is probably on an adventure with Clifford

> For Sweden

dtg11 - is probably on an adventure with Clifford

> For Sweden

03/09/2020 at 00:45 |

|

Iím not complaining, I got premium for $2.45/gal this week, regular was $1.97

Just Jeepin'

> For Sweden

Just Jeepin'

> For Sweden

03/09/2020 at 00:48 |

|

I remember the first time gas crossed the $1 threshold, and how many gas stations had pumps that couldnít handle those prices. I was a pizza delivery driver so you bet I paid attention.†

Rusty Vandura - www.tinyurl.com/keepoppo

> For Sweden

Rusty Vandura - www.tinyurl.com/keepoppo

> For Sweden

03/09/2020 at 01:06 |

|

Glad I cashed in some of my TSLA two weeks ago.

Rusty Vandura - www.tinyurl.com/keepoppo

> facw

Rusty Vandura - www.tinyurl.com/keepoppo

> facw

03/09/2020 at 01:06 |

|

Lucky for them there's no covid-19 in Russia.

Rusty Vandura - www.tinyurl.com/keepoppo

> LastFirstMI is my name

Rusty Vandura - www.tinyurl.com/keepoppo

> LastFirstMI is my name

03/09/2020 at 01:07 |

|

Saudi election... Have a bone saw.

Rusty Vandura - www.tinyurl.com/keepoppo

> LastFirstMI is my name

Rusty Vandura - www.tinyurl.com/keepoppo

> LastFirstMI is my name

03/09/2020 at 01:08 |

|

No, it's Keep Arabia Great.

gettingoldercarguy

> For Sweden

gettingoldercarguy

> For Sweden

03/09/2020 at 02:39 |

|

Saudis do their own hacking.

pip bip - choose Corrour

> For Sweden

pip bip - choose Corrour

> For Sweden

03/09/2020 at 03:23 |

|

\0/

Gerry197

> facw

Gerry197

> facw

03/09/2020 at 03:47 |

|

They tried that with US Frackers years ago and it ruined their ability to control the market because it allowed the Frackers to become much more efficient and profitable at a much lower price than before.

This is why we will likely never get extended high oil prices again, US Frackers can undercut any attempt by OPEC to raise prices by lowering production.††

Cť hť sin

> For Sweden

Cť hť sin

> For Sweden

03/09/2020 at 05:34 |

|

Thatís made bugger all difference to the price at my nearest pumps though.

duurtlang

> Cť hť sin

duurtlang

> Cť hť sin

03/09/2020 at 05:44 |

|

Thatís because most of the price of your gasoline is based on taxes, not oil costs.

Itís a quite common observation that when oil prices rise, so do fuel prices. When oil prices drop, fuel prices only drop marginally. Because they donít have to, when they drop only half of how far †they should drop you will still perceive it as Ďcheapí. Oil prices will have to remain low for a longer period of time before you really notice it at the gas station.

Spanfeller is a twat

> For Sweden

Spanfeller is a twat

> For Sweden

03/09/2020 at 05:45 |

|

Usually the Mexican government does some astute oil hedges that let us survive these kinds of drops... But given this adminstration has their heads up their asses, indebting themselves building a fucking oil refinery, maybe this is the shock that wakes them up.

Thomas Donohue

> For Sweden

Thomas Donohue

> For Sweden

03/09/2020 at 07:41 |

|

The futureís are so bright (red), I gotta throw shade.

Thomas Donohue

> Rusty Vandura - www.tinyurl.com/keepoppo

Thomas Donohue

> Rusty Vandura - www.tinyurl.com/keepoppo

03/09/2020 at 07:43 |

|

It was all a big misunderstanding. It was a coffee Facebook page called ĎMake Arabica Great Againí.

They werenít trying to overthrow anyone, just get some good joe.

Gone

> Gerry197

Gone

> Gerry197

03/09/2020 at 09:17 |

|

ShaleCoís donít actually make any money. Banks are finally figuring that out. No more loans and shrinking revolvers were already killing off companies. Almost all had lowered Capex for 2020. Lots of debt due in the next year or two which wonít be refinanced ($2-300 b illion, total debt near $600B ) due to the above. † A bunch of them had hedges roll off recently or will soon, so oops. They couldnít even make money last year at ~$55/bbl, lost $2-3B overall . The drilling efficiencies is a bit of a misdirection, still costs $6-8 MM or more to drill/complete those long laterals, not including land, LOE, etc . R ising GORs and decline rates are a huge issue as well . Natty gas is in an awful position too , as is LNG.

If this lasts long at all, many of them will get crushed. Maybe see some M&A will big coís, but that will also stabilize prices. ShaleCoís burning money and wasting resources (flaring

that gas

)

while not actually making investors any money

will finally stop.

2020 is pretty boned for oil, oversupply was already happening with the slowing econ

om

y and coronavirus to the tune of 2-3MMbbl

/d. If the US gets slammed, thatíll to maybe 5MMbbl

. Add in Saudi threatening to bump to 12MMbbl, and 21 might be screwed too. Only so much storage for the stuff (and Saudi has more capacity than Russia).

Layoffs coming. Big crew change is delayed again and no more kids will come to O&G.

66P1800inpieces

> MrDakka

66P1800inpieces

> MrDakka

03/09/2020 at 10:04 |

|

†I feel shitty when I buy puts.††

Rusty Vandura - www.tinyurl.com/keepoppo

> Thomas Donohue

Rusty Vandura - www.tinyurl.com/keepoppo

> Thomas Donohue

03/09/2020 at 11:05 |

|

Theyíll get some if Biden wins in November and hasnít caught the virus and died.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/09/2020 at 11:35 |

|

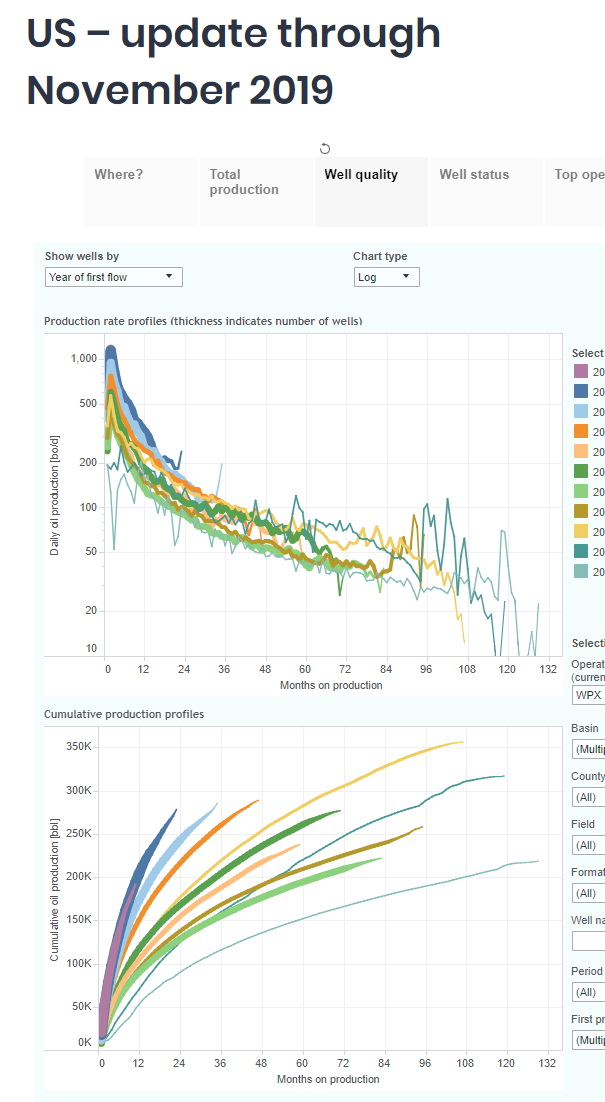

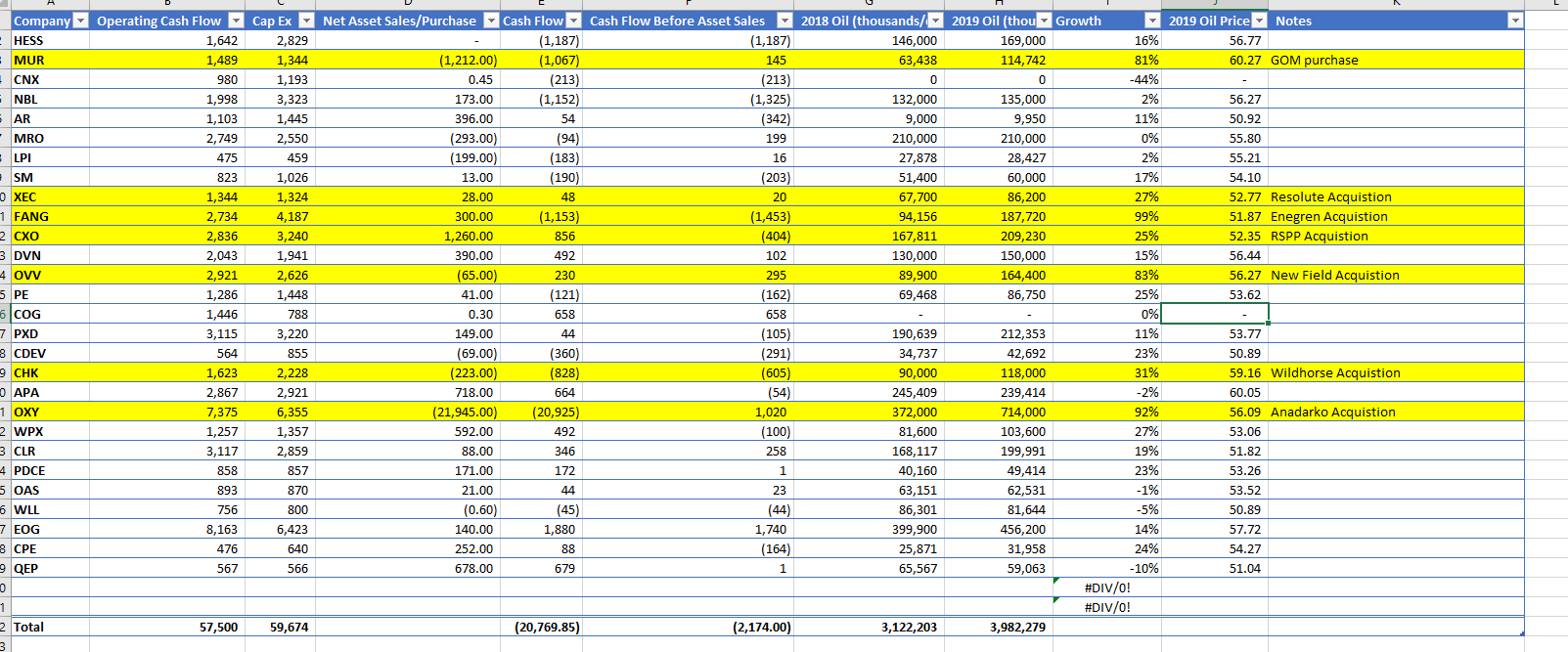

Very specific question: whatís your opinion on WPXís

ability to weather this storm? What about LPI?

Will they make it through to the other side?

Not really asking about the stock price, more the longevity of the company.

Interesting thought this morning: if oil prices stay this low, many producers in the Permian will turn off the taps, which means associated gas will go away on the supply side, which might mean that natural gas prices will rebound...

MrDakka

> 66P1800inpieces

MrDakka

> 66P1800inpieces

03/09/2020 at 11:50 |

|

I do too, but then I look at my account balance. $SPY puts certainly printed today.

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/09/2020 at 12:28 |

|

Def not giving investment advice, but have thoughts.

A very not thorough answer

, but off the top of my head:

†

WPX is based in OK, so I wouldnít trust them - same with any CO ShaleCos lol. They

announced theyíre buying Felix in Dec (IIRC) for an obscene amount of money ($

2.5B?)

. Felix had a big Delaware concentration, which is a gassy/water mess, and is run by EnCap, a bunch of PE/VC jokers. Technically hasnít closed I donít believe

, but I think itís a mistake

. VC gonna get their money...

Letís have a quick look and production and o

uch:

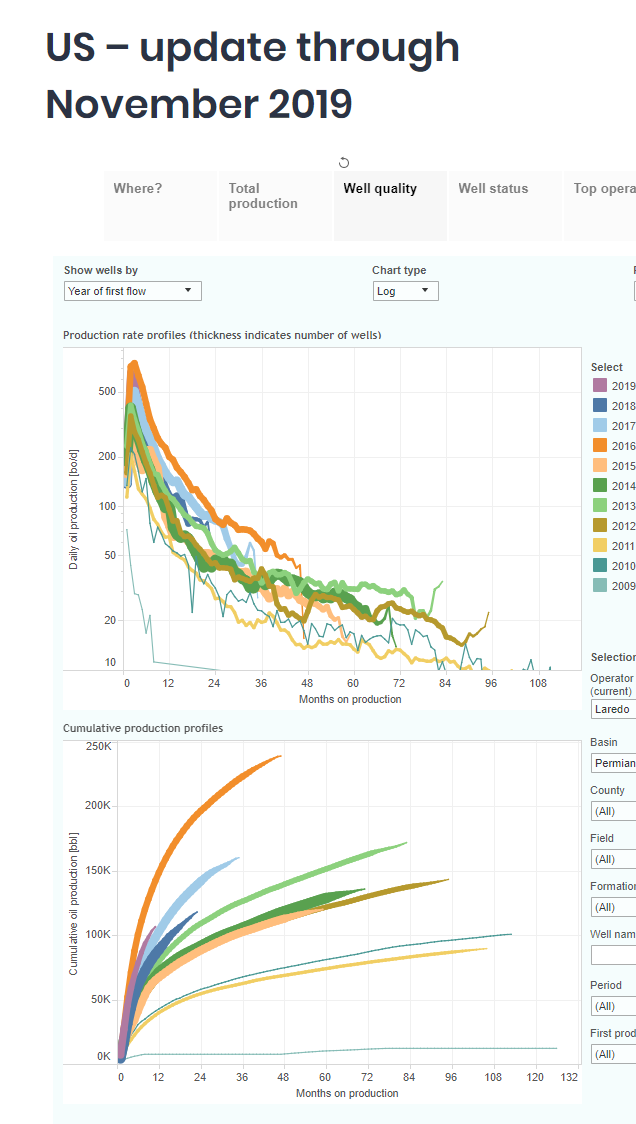

LPI is also

based in OK

. Theyíre tiny and have quite a debt burden - and working their way towards being delisted at this rate. Their fin

a

nc

ing and revolv

er is bound to disappear

. IIRC they have some gassy Tier2/3 in Howard. WCamp is a shitty place to drill. Having a midstream service right now is doing them no favors either. This chart is not a happy one:

Those cumlatives are pretty bad. Can take 600k+ to be profitable, formation depending

. I think both planned to FCF at $55 this year, which could pay some debt service, but it ainít happening.

Russia was big on committing to producing a lot of gas, so thatís a danger. Haynes produces a buttload of gas lol and they need to lay down rigs too.

Fun chart for ref off the twitters:

Gone

> Gone

Gone

> Gone

03/09/2020 at 12:45 |

|

WPX closed on Felix this morning. Great timing y ía ll. LOL I canít even.

Darius Raqqah

> Gerry197

Darius Raqqah

> Gerry197

03/09/2020 at 13:04 |

|

Ne ed to assume the decline in Wall St. investment doesnít continue, when more likely, it will be exacerbated.

Small/Medium US shale companies look fucked. It's not 2014 anymore. Rig number decline looks unsustainable too.†

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/09/2020 at 13:15 |

|

Oof. Yeah, I thought it was too late to back out.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/09/2020 at 13:19 |

|

Thanks for the detailed response. I work in the industry in Tulsa, and those are two of the larger O&G employers here. Whatís bad for the industryís health is bad for the regionís health...

Was already a challenging market, then coronavirus, then the Saudis.

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/09/2020 at 13:52 |

|

NP. No offense on the OK crack, just CO and OK companies have big leverage issues. Well, all shale does, but those places are shale only coís.

Hate to see all the dudes busting ass to make a paycheck get hosed because of misallocation of capital from upstairs.

Check CVE today if you want to laugh/cry... O&G has been in a rough place for a few years.

Iím in offshore, so we didnít get any of that sweet sweet VC funding lol

. Been watching shale play loose and fast with funding (and reporting tbh) for awhile. Banks finally getting smart (maybe). Offshore will just continue to be ignored via capex at this price point. We also h

ad huge layoffs in 14-15, hopefully few going forward, but depends on how long this goes on.

Good luck - h ope you make it out fine.

davesaddiction @ opposite-lock.com

> Gone

davesaddiction @ opposite-lock.com

> Gone

03/09/2020 at 15:12 |

|

Thanks, back at you. Been through a couple layoffs in my 15 years (one with a divestiture , one with an office closure), and Iíve thankfully ended up better off after each one. The whole environment feels different right now - was tough already, and then the coronavirus, and then this... I s this what the Ď80s felt like?

Guess weíll see who flinches first, the Saudis or the Russians! Iím guessing they both have enough pride to make this last way longer than many can ride out.

Gone

> davesaddiction @ opposite-lock.com

Gone

> davesaddiction @ opposite-lock.com

03/09/2020 at 16:47 |

|

I keep hearing 1986, which is not something you say lightly in O&G. I wasnít around then either though

.

If this lasts long at all, all I can see is bond and covenant violations all over the place. Banks can/

will go on default debt

collection spree.

Huge egos all around

, would think

Russia flinches first (money or storage). O

nly other

way out is to turn their current ME

proxy wars into a shooting war. Nothing appealing about any of this...

Darius Raqqah

> Gone

Darius Raqqah

> Gone

03/09/2020 at 20:04 |

|

E xactly.

66P1800inpieces

> MrDakka

66P1800inpieces

> MrDakka

03/09/2020 at 21:22 |

|

I will occasionally buy a couple hundred bucks of puts for CCL (Carnival) with a strike a couple weeks out for a couple bucks below recent trading (around .30 option) if the toilets overflow or similar.† It grabs headlines and pushes down prices.† I did that a couple weeks ago and felt horrible bc people were dying s o I sold them even.† I plan to buy UPRO (maybe even some options to multiply the leverage) once we start to appear on the way up.†

MrDakka

> 66P1800inpieces

MrDakka

> 66P1800inpieces

03/10/2020 at 08:53 |

|

Are you planning on doing the 55/45 UPRO/TMF risk parity split?